ANZ Trading Update - 3 months to 31 December 2014

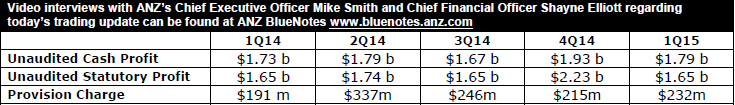

ANZ today announced an unaudited cash profit1 of $1.79 billion and an unaudited statutory net profit of $1.65 billion for the 3 months to 31 December 2014.

ANZ Chief Executive Officer Mike Smith said: “ANZ has made a solid start to 2015 with our customer franchises in Australia, New Zealand and Asia continuing to perform strongly.

“As we anticipated, 2015 is proving to be a slightly tougher, more volatile environment. We have seen some tailwinds associated with the lower Australian dollar in the first quarter however these have been partially offset as a result of global economic conditions including lower commodity prices. Market conditions have also created a challenging environment for the Global Markets business although we expect this to improve throughout the year.

“Overall ANZ is performing broadly in line with our expectations. Our super regional strategy continues to provide us with growth options and we will also ensure our cloth is cut to suit the conditions.

“Looking at our businesses, Australian Retail and Commercial have delivered another excellent performance with further market share gains in home lending and growth in small business lending although the corporate sector remains subdued. In New Zealand our market position is seeing us benefit from the economic upturn supported by further productivity outcomes. Global Wealth has again performed well.

“In International and Institutional Banking the effect of the macro environment has been more apparent including the impact of central bank monetary policy on margins. Monetary policy however is continuing to support a stable outlook for credit quality across all our businesses,” he said.

GROUP OVERVIEW2

- Profit before Provisions grew 5.2% versus the prior comparable period and rose 3.6% on a constant Foreign Exchange (FX) basis.

- Revenue was above the quarterly average3 for FY14 with benefits from the decline in the Australian dollar exchange rate4 partially offset by lower Global Markets trading income. Expenses were also higher than the FY14 quarterly average reflecting exchange rate impacts along with several key business enhancement projects becoming operational. This included a new digital platform for the Australian business which provides better product speed to market and customer interface. ANZ continues to invest in growth opportunities and enablement capability.

- Customer deposits grew 9% with net loans and advances up 8%. Deposit growth was strong across all geographies with lending demand varied across the Group and customer pay-down levels remaining elevated.

- Group Net Interest Margin declined 6bps compared with the end of the second half FY14, 2bps of which related to foreign exchange translation impacts. The remainder was largely attributable to Global Markets and the impact of higher liquidity requirements.

- The APS330 released today shows continued portfolio quality improvement, with further reductions in impaired assets. The provision charge of $232m was slightly lower than the FY14 quarterly average with no reduction in the management overlay balance during the period.

- Excluding the impact of the FY14 final dividend payment, CET1 capital improved by around 20 bps. At 31 December the capital ratio on an APRA CET1 basis was 8.4% (11.9% Basel 3 Internationally Comparable basis). Risk Weighted Assets increased $17.4 billion of which $8.2 billion was attributable to FX translation which has a negligible impact on Group CET1.

- While the lower AUD exchange rate benefits ANZ in aggregate as per disclosures made at the FY14 results5, there is a range of impacts across various metrics.

DIVISIONAL HIGHLIGHTS

- The Australia Division is performing strongly, with all core segments contributing. Home lending has continued to grow at above system rates, with the fastest growth occurring in New South Wales. Targeted campaigns, leveraging our digital sales capabilities, have seen the Credit Cards business rebound, posting the highest market share gains of the major banks in the past 6 months. Commercial lending momentum has been maintained following the trend in the second half of FY14, particularly in Small Business Banking. Deposit growth trends were also positive, especially in Commercial, and ANZ has maintained market share in Household Deposits.

- The New Zealand Division is also performing strongly delivering balance sheet growth with market share steady in the competitive mortgages market and deposit growth also strong. Ongoing benefits from the brand and systems merge continue to contribute to positive income expense jaws and the credit environment remains benign.

- Global Wealth continues to build momentum, delivering strong in-force premiums growth, stable claims and lapse experience together with further growth in Funds under Management. Innovations including ANZ Smart Choice Super, the GROW by ANZ digital platform and the ANZ Grow Centre are driving greater adoption of Wealth products by both new to bank and existing ANZ customers.

- International and Institutional Banking had a mixed start to the year. Trade volumes have been consistent; however significant reductions in commodity prices are impacting the value of shipments and providing a revenue headwind. Cash Management saw significant growth in volumes, particularly in Asia, with margins slightly improved. The Global Markets business delivered its strongest quarterly customer sales result in two years; however total Markets revenues (1Q15 $555 million) were down on the quarterly average for last year reflecting lower trading income. The business settings remain conservative with the value at risk (VaR) tracking below 2014 levels.

OUTLOOK

ANZ’s super regional strategy focussed on Australia, New Zealand and Asia Pacific supported by a healthy level of organic capital generation, will continue to provide the Group with opportunities to invest in the business and deliver for shareholders. It is expected that the dividend payout ratio will remain at the upper end of the target range for FY156.

1 Statutory profit is adjusted to exclude non-core items to arrive at Cash Profit, the result for the ongoing activities of the Group.

2 Comparisons referenced are 1Q15 (period to 31 December 14) relative to 1Q14 (period to 31 December 13) and are not FX adjusted unless otherwise noted.

3 Comparison is against quarterly average revenue for FY14 of $4.89 billion and quarterly average expenses for FY14 of $2.19 billion.

4 Refers to the AUD exchange rate against the USD and NZD predominantly.

5 Slide 51 ANZ Full Year 2014 Results Presentation & Investor Pack “FX Sensitivity – illustrating the impact of FX”.

6 ANZ’s target dividend payout ratio previously advised is between 65% and 70% of Cash Profit.